Arizona’s Bioscience Roadmap—a long-term strategic plan commissioned by the Flinn Foundation—has been a catalyst for developing Arizona’s bioscience ecosystem since 2002. Members of Arizona’s Bioscience Roadmap Steering Committee, joined by hundreds of private- and public-sector leaders, have used the Roadmap for more than two decades to support expansion of the state’s research infrastructure, commercialization capabilities, and bioscience companies and health systems.

Arizona’s bioscience journey reflects both rapid growth and resilience in uncertain times. Over two decades, the state has evolved from a modest bioscience presence into a rising bioscience ecosystem, driven by strong anchor institutions, deepening bioscience specializations, adjacent tech industry expansion, and a growing talent base. The next five years will be pivotal as Arizona seeks to translate momentum into national leadership while navigating funding volatility, global competition, and talent retention—turning progress into lasting, transformative impact.

Defining Bioscience

Bioscience focuses on the research, development, and commercialization of therapies and products to prevent, diagnose, and treat disease, improve health outcomes, enhance crops, and generate biological solutions for environmental and industrial challenges. It employs scientific methods to understand normal and abnormal biological processes and answer profound questions about what life is, how it works, and how it changes. Bioscience plays a central role in addressing many global challenges and improving quality of life for future generations.

Arizona’s bioscience ecosystem is made up of six subsectors, each with an important role in improving outcomes for Arizonans and beyond.

- Agriculture Feedstock and Industrial Biosciences: Agricultural R&D, processing, and organic chemical and fertilizer manufacturing.

- Bioscience-Related Distribution: Highly regulated coordination and delivery of pharmaceuticals, medical devices, and ag biotech.

- Hospitals: Providers of clinical care and partners in discovery and commercialization with universities, research institutions, and private companies.

- Medical Devices and Equipment: Development and manufacturing of medical implants, instruments, supplies, and lab equipment.

- Pharmaceuticals: Development and production of biological and medicinal products, pharmaceuticals, and diagnostic substances.

- Research, Testing, and Medical Laboratories: Biotech and other life-science R&D, and testing and medical labs.

A Shifting Context

The bioscience sector in Arizona and beyond is in a period of profound disruption and uncertainty—yet also opportunity. Federal research budgets are unstable, early-stage capital is shifting heavily toward artificial intelligence, and public trust in science has weakened. At the same time, bioscience discovery is entering a new golden era: CRISPR is reshaping medicine and agriculture, mRNA platforms are redefining vaccine development, immunology is unlocking new cancer therapies, and AI is supercharging drug discovery and diagnostics. For Arizona, the moment is clear: adapt to disruption, harness convergence with adjacent industries, and translate discovery into impact.

Progress and Momentum

Despite challenges, Arizona has achieved nationally competitive growth across the biosciences. Its progress is evident on multiple fronts:

- Talent expansion: There were more than 25,000 bioscience-related program completions in 2023, with completions growing rapidly in Arizona as the nation as a whole saw a decline. Yet retention remains inadequate, with too many graduates leaving for coastal markets or staying in Arizona but working in tech-based sectors beyond bioscience.

- Research momentum: NIH funding in Arizona reached a record $368 million in FY24, growing nearly four times faster than the national average. Flagship institutions are producing notable breakthroughs while carving distinct strengths—U of A in biomedicine, ASU in bioengineering and computing, and NAU in pathogen genomics.

- Commercialization signals: Patent activity is accelerating, trademarks are growing, and tech transfer reforms are underway. However, startup formation and licensing still lag, limiting translation of intellectual property into companies and jobs.

- Capital inflows: Arizona raised $1.1 billion in bioscience venture capital from 2019 to 2023. But this represents less than 1% of the U.S. total and is concentrated in a handful of firms, underscoring the fragility of the funding base.

- Ecosystem maturity: Innovation hubs like the Phoenix Bioscience Core and Tech Parks Arizona have become convergence zones. Yet infrastructure remains fragmented, with labs and testbeds underutilized, angel networks weakening, and industry associations underpowered compared to peers.

The result is an ecosystem that has outpaced the U.S. in job growth and research funding growth, though it still operates at a smaller scale than benchmarks like Colorado, North Carolina, and San Diego. Even so, Arizona’s trajectory demonstrates high potential: The pace of progress shows that with continued investment and coordinated action, the state can build on its growth, achieve greater success, and begin transitioning from momentum to long-term leadership. While challenges remain, the foundation sets the stage for the next set of strategies to sustain and accelerate Arizona’s rise.

The Imperative Ahead

Bioscience Roadmap Vision: 2025–2030

Arizona is a nationally recognized, rising bioscience leader with a skilled talent base, world-class research, and dynamic industry growth. It exemplifies collaboration, agility, and the courage to bet on discoveries that strengthen the economy and Arizonans’ health and quality of life.

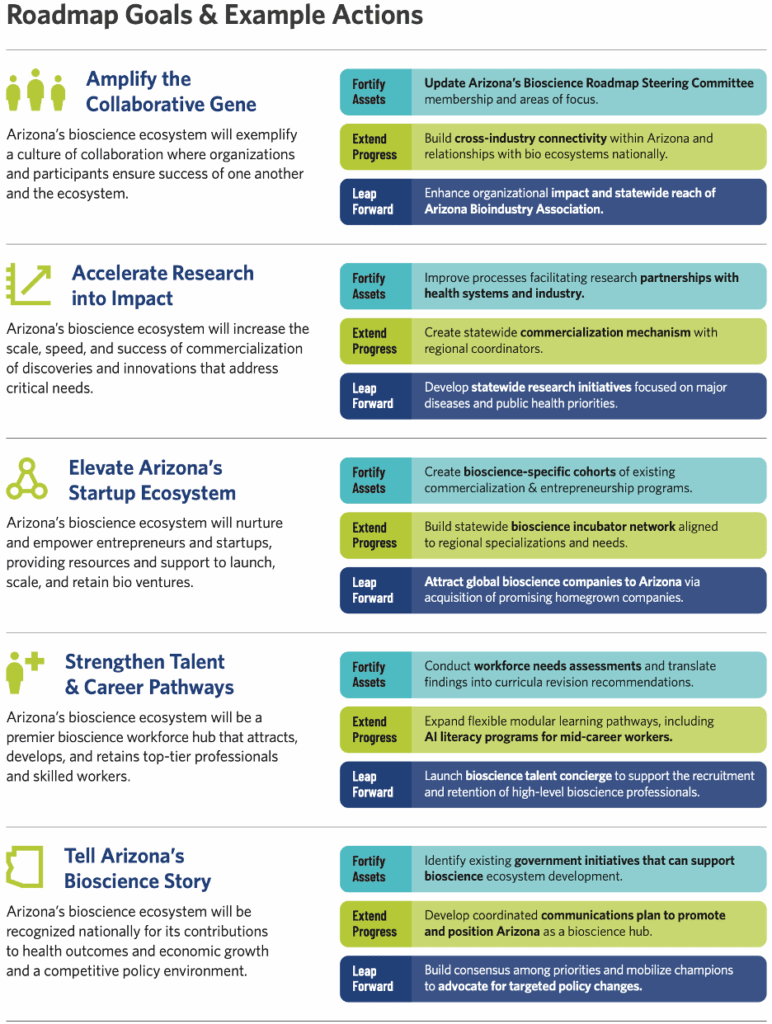

As described below, the Roadmap lays out five goals and 15 strategies – each with an accompanying set of actions – that are designed to help Arizona navigate an unstable period of threatened resources and technological revolution to emerge as a rising bioscience leader.

Arizona’s bioscience sector has momentum, but momentum alone will not suffice. Without deeper commercialization infrastructure, broader capital access, stronger workforce alignment, and unified communications, the state risks falling short of its potential. The Roadmap challenges Arizona to bet boldly on collaboration, talent, and discovery translated into impact.

By executing on the Roadmap, Arizona can achieve four defining outcomes:

- National competitiveness in select bioscience domains such as neuroscience, oncology, precision medicine, and medical devices.

- A robust startup pipeline fueled by stronger capital markets and commercialization capacity.

- A resilient talent base and unified brand that attracts and retains top researchers, entrepreneurs, and investors.

- Effective translation of innovation into impact through manufacturing and care delivery.

Roadmap Goals and Strategies

GOAL 1: Amplify the Collaborative Gene

Arizona’s bioscience ecosystem will exemplify a culture of collaboration where organizations and participants ensure success of one another and the ecosystem. This will be facilitated through institutionalized collaboration that aligns stakeholders, leverages complementary sectors, forges new opportunities across regions, and builds connectivity to global markets.

Strategy 1.1: Update Arizona’s Bioscience Roadmap Steering Committee to ensure strategic coordination of efforts and activate a new generation of bioscience leaders.

Strategy 1.2: Enhance the impact of the Arizona Bioindustry Association.

Strategy 1.3: Build connectivity with other technology-intensive industries in Arizona to create a more integrated innovation ecosystem.

Strategy 1.4: Engage with complementary bioscience ecosystems beyond Arizona to leverage partnership opportunities for investment, innovation, and talent development.

GOAL 2: Accelerate Research into Impact

Arizona’s bioscience ecosystem will increase the scale, speed, and success of commercialization of bioscience discoveries and innovations that address critical needs. This will be accomplished through new partnerships and resources that create an approachable and opportunity-rich environment for researchers to translate findings into solutions that address real-world challenges.

Strategy 2.1: Strengthen partnerships between research institutions, health systems, and industry to accelerate bioscience commercialization and tech transfer.

Strategy 2.2: Create a statewide bioscience commercialization network to support researchers and entrepreneurs across the state.

Strategy 2.3: Develop statewide research initiatives focused on major diseases and public-health priorities.

GOAL 3: Elevate Arizona’s Startup Ecosystem

Arizona’s bioscience ecosystem will nurture and empower bioscience entrepreneurs and startups, providing the resources and support needed to launch, scale, and retain more bioscience ventures. Even in a time of decreased federal support, traditional research institutions will continue to play a critical role in bioscience innovation. However, startups are increasingly taking on more of the bioscience developmental risk that in the past was born by large corporations. Thus, a strong entrepreneurial community will benefit individual startups and be a flywheel to catalyze reinvestment and growth of the ecosystem. The end goal of this ecosystem development work will be demonstrated if new bioscience startups are increasingly created, sustained, and retained in Arizona, and ultimately attract the attention and investment in Arizona of more global-scale bioscience firms.

Strategy 3.1: Diversify the investment base for Arizona’s entrepreneurial ecosystem to increase access to capital for emerging bioscience companies.

Strategy 3.2: Scale innovation and commercialization programs that offer tailored programming and mentorship in specific bioscience fields or technologies.

Strategy 3.3: Build a statewide bioscience incubator network aligned to regional specializations and needs.

GOAL 4: Strengthen Talent and Career Pathways

Arizona’s bioscience ecosystem will be a premier bioscience workforce hub that attracts, develops, and retains top-tier professionals and skilled workers. This will be demonstrated by Arizona becoming a residence of choice for workers and destination of choice for companies requiring a large, skilled, and sustained talent pool.

Strategy 4.1: Unite education institutions and employers to align Arizona’s bioscience talent pools with evolving labor needs.

Strategy 4.2: Implement and scale effective workforce development programs.

Strategy 4.3: Establish a bioscience talent concierge to recruit and retain transformative research, clinical, entrepreneurial, and business talent.

GOAL 5: Tell Arizona’s Bioscience Story

Arizona’s bioscience ecosystem will be recognized in-state and out as a national leader by policymakers, investors, potential collaborators and other key constituencies for its contributions to health outcomes and economic growth, together benefiting all Arizonans. This will be demonstrated through an increased media presence and the emergence of a more competitive policy environment that strengthens the ecosystem’s long-term competitiveness.

Strategy 5.1: Promote and position Arizona as a bioscience hub with a coordinated communications plan.

Strategy 5.2: Advocate for policy to enhance Arizona’s competitiveness.

The Roadmap in Action

The infographic below summarizes the Roadmap goals with example actions that illustrate how Arizona can strengthen its foundation and advance toward national leadership in the biosciences.

Some of the proposed actions are intended to fortify and protect assets through difficult times. Some actions would extend exciting progress that Arizona has already made. And some would enable true leaps forward. In certain instances, Arizona’s current environment may not today be ripe for the most audacious actions, and there the charge to bioscience leaders and supporters is to prepare, to ensure that Arizona is ready for an opening when it arrives.